NOTE: As of 2023, InkSoft is currently rolling out our new embedded payments system. If you would like to be considered for the beta wave, please submit your request by filling out our form here.

Poor cash flow management can kill any business. Receiving quicker payments on invoices is critical to managing cash flow and the financial health of your business. We’ve prepared six simple ways you can encourage your customers to pay their invoices on time or early.

Give em’ a carrot

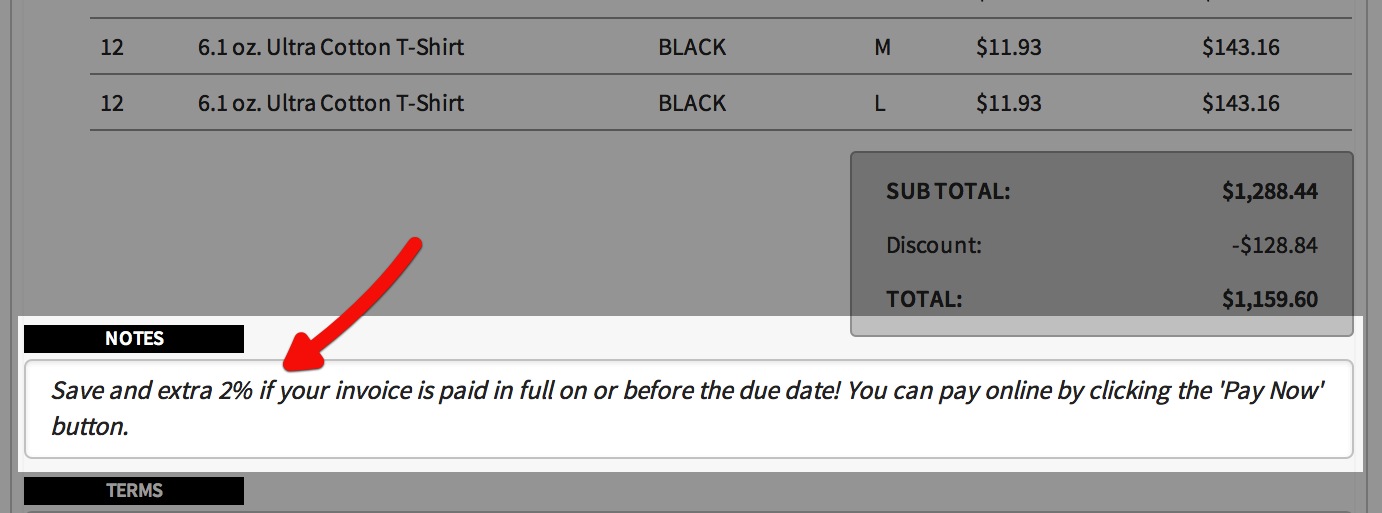

All consumers like deals and savings right? Consider offering your customers a small savings if they pay their invoice in full on or before the due date. Consider the following:

- Save an extra 2% on invoices paid in full upon receipt of invoice

- Save an extra 2% on invoices paid in full on or before due date

- Discounts or special offers valid if invoices are paid in full on or before due date

In InkSoft Business Tools, you can use the notes area and email function to communicate the special savings value.

Give em’ a stick

Perhaps your customer doesn’t respond to your small discount for on-time or early payment. Consider adding a small penalty for late payment on invoices. This can be achieved in two ways:

- Void and discounts or special offers

- Add a fixed dollar amount, or a percentage of the invoice as a ‘late fee’

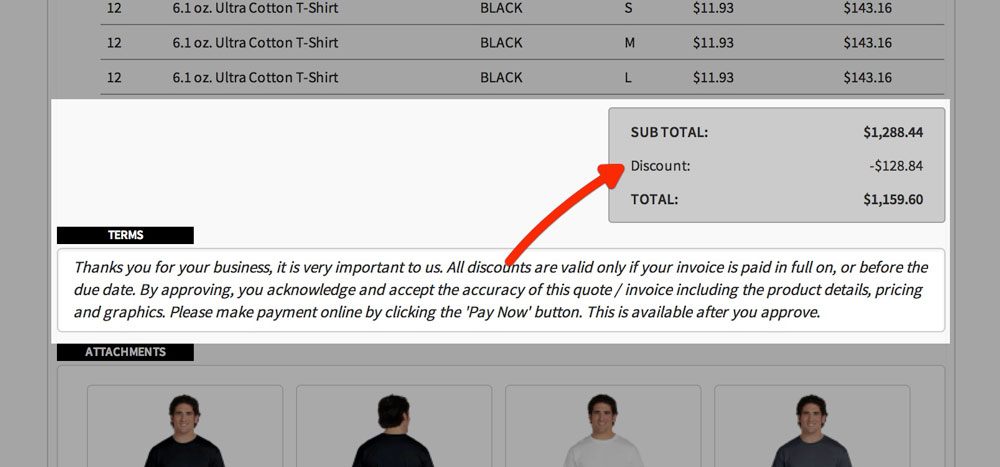

In InkSoft Business Tools, you can define your ‘terms’ for quotes, invoices and art approvals. Tip: You can customize / modify terms at each quote, invoice and art approval.

Change your habits

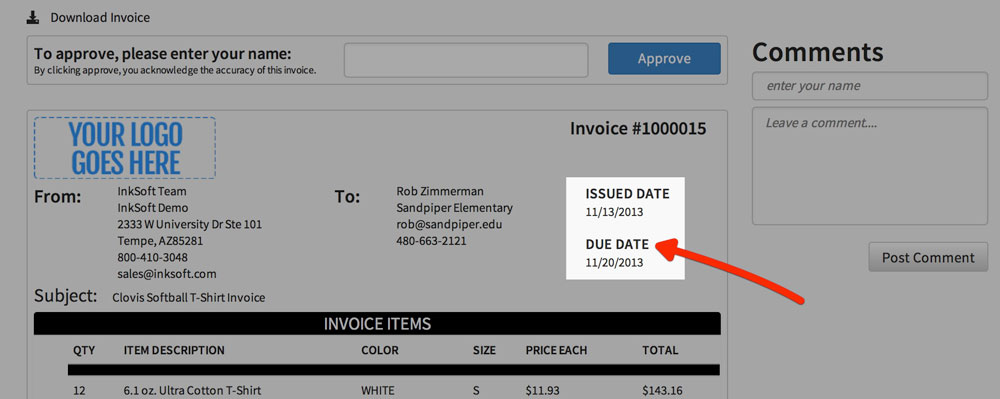

So many invoices have gracious payment due dates. Why? The longer your due date, the greater chance of your customer forgetting to make payment. Consider some of the following strategies:

- Payment due in full at time of approval

- 50% deposit up-front, balance due at pick up or before shipping

- Payment due within 5 days of receipt of invoice

In InkSoft Business Tools, you can input the due date which reflects on the quote or invoice.

Make it easy

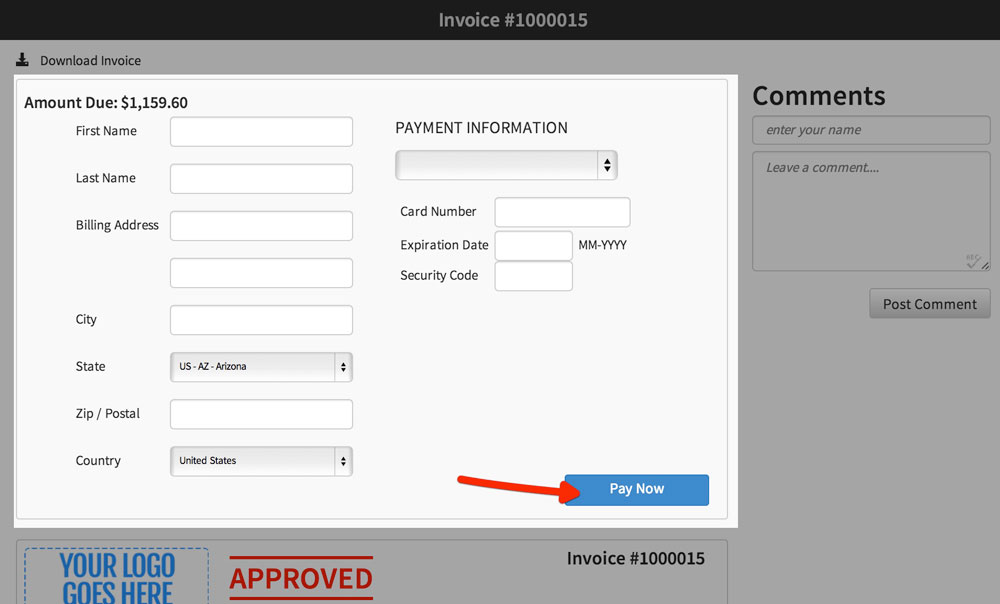

You should make online electronic payment an option for your customers. It’s fast, easy and nearly instant. Additionally, electronic payment provides a small measure of insurance. Consider if you accept a check and there are non-sufficient fund,s you would be stuck playing debt collector. If the payment is processed electronically you avoid this situation.

In InkSoft Business Tools, you can process payments manually and allow your customers to pay online!

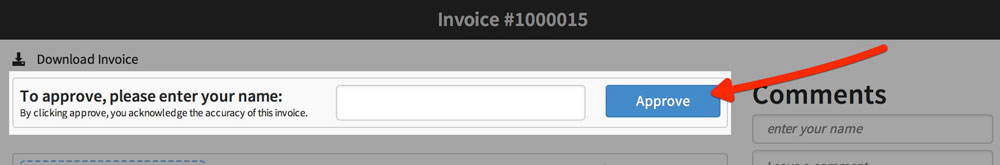

Put it in writing

Stating your ‘terms’ in writing and having your customer agree is an absolute must. By having your customer agree / acknowledge / accept your terms in writing, you help ensure that the terms are clearly communicated. This helps to eliminate any excuses or confusion.

Consider the following criteria in your payment terms

- Acceptable forms of payment

- Due date(s)

- Late fees or voiding of discounts

In InkSoft Business Tools, you can define your terms and record who approves any quote, invoice and art approval.

Organize & Follow up

In a perfect world the step above would be enough to get paid faster. You will need to organize and follow-up on all invoices to ensure prompt payment. Consider the following follow techniques:

- Schedule follow ups two days before invoice due dates to provide a reminder

- Email follow-up is good — a phone call is better. Take an opportunity to call your customers and thank them and remind them of their upcoming invoice due date. Play good cop! ‘We want to make sure you save the extra 2%…’

- Be consistent: Develop a follow-up system and use it consistently

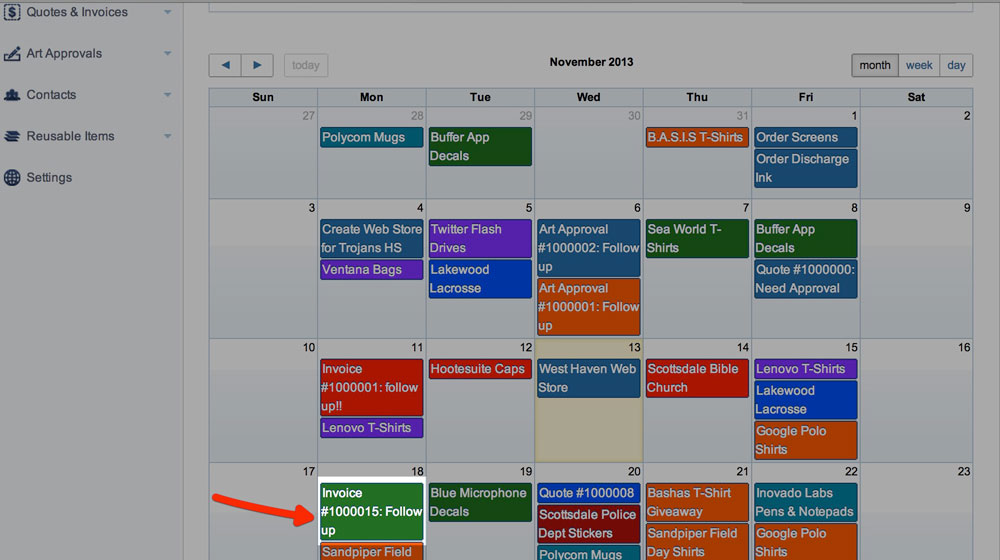

InkSoft Business Tools comes with a very simple, yet powerful tool for scheduling follow ups for quotes, invoices and art approvals. Business Tools’ Calendar will allow you to drip down to see your follow ups